What Long-Term Data Reveals About Beating the Market

Jan 1, 2026

Endeavor Advisors

Many investors believe that hiring a highly educated, experienced investment manager will lead to better returns. It sounds reasonable. After all, skill and expertise matter in most professions. However, investing works differently. Over time, research consistently shows that stock-picking and market-timing rarely lead to better results, even when done by seasoned professionals. Below, we explain why this happens and what it means for long-term investors.

What the Data Shows About Professional Investors

A common belief is that professional fund managers can reliably outperform the stock market. To test this idea, researchers examined the long-term results of U.S. equity mutual fund managers, many of whom hold advanced degrees like MBAs or PhDs and have decades of experience.

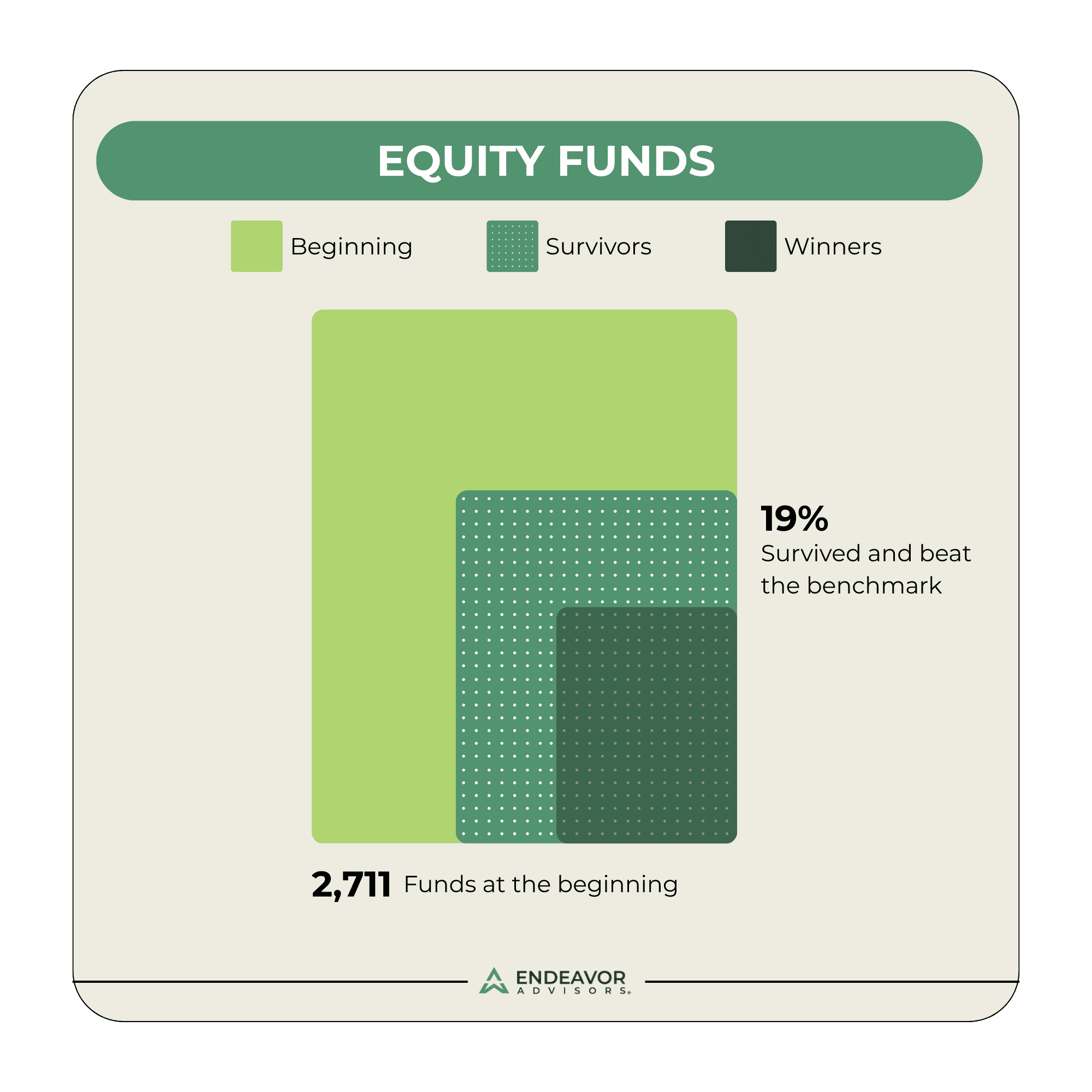

Researchers tracked 2,711 U.S. equity mutual funds that existed at the start of the 15-year period beginning in 2000.

These funds were compared to appropriate benchmarks, which are standard market measures used to evaluate performance (such as the S&P 500).

A fund was considered successful only if it survived the entire period and outperformed its benchmark.

The results were eye-opening. Only about 1 in 5 funds met both criteria. That means fewer than 20% of professional managers delivered better-than-market results over a long period.

This data highlights a key point: even the most credentialed professionals struggle to consistently beat the market, making stock-picking a risky strategy for long-term investors.

This graphic illustrates the long-term outcomes of U.S.-based equity mutual funds over a 15-year period ending in 2014. The data comes from a comprehensive, survivor-bias-free database that includes both funds that still exist and those that were shut down or merged. The image shows how many funds failed to survive and how few managed to outperform their benchmarks. The key takeaway is that strong past performance does not reliably predict future success, and many funds that once appeared promising did not deliver superior results over time.

Why Competition Makes Beating the Market So Hard

When we need a professional such as someone to fix a roof, argue a case, or diagnose an illness, we usually follow the same process. We research, ask for referrals, and hire the most qualified person we can find. The assumption is simple: the most skilled professionals deliver the best outcomes. In most fields, that logic holds up pretty well.

But investing plays by different rules. Doctors, lawyers, and accountants are not competing against one another in a zero-sum game. A doctor only needs to arrive at the correct diagnosis, and in many situations, competent doctors will independently reach the same conclusion. One doctor being right doesn’t require thousands of others to be wrong.

Investment management, however, is fundamentally competitive. For an investment manager to outperform the market, it’s not enough to be smart or well trained. They must correctly value an asset while the collective judgment of other investors (the market itself) gets it wrong. Outperformance requires disagreement, not consensus.

Put differently, hiring an active investment manager is like betting that your doctor’s diagnosis is more accurate than those of thousands of equally trained peers. That doesn’t mean it’s impossible, but it does mean the odds work very differently than they do in most other professions.

A Sports Analogy That Explains Investing Reality

A helpful way to understand investing is to compare it to professional sports.

Even the best baseball hitters fail more often than they succeed.

A batting average above .300 is considered excellent, yet that still means failing most of the time.

The reason isn’t lack of skill. It’s competition against equally talented opponents.

Investment managers face the same challenge. They compete against other highly trained professionals who are just as motivated and informed.

No matter how skilled a manager is, long-term outperformance is rare.

Markets evolve, competitors adapt, and any advantage tends to disappear quickly.

This explains why short-term success does not usually persist and why relying on stock-picking is an unreliable strategy for long-term financial goals.

How Fees Quietly Undermine Returns

Even if skill were evenly distributed, fees tilt the odds against active investing.

Mutual funds incur trading costs, which can add up to roughly 0.5% per year.

Most actively managed funds also charge management fees of about 1.0%–1.5% annually.

Together, these costs create a hurdle of nearly 2% per year.

To put this in simple terms:

If the market returns 7% in a given year, a fund may need to earn around 9% before fees just to keep up.

Over time, these extra costs compound and significantly reduce investor returns.

Fees are one of the strongest reasons why market-timing and active stock selection fail to deliver consistent value.

Why the Odds Favor a Different Approach

Despite overwhelming evidence, many funds continue to market themselves as exceptional.

The mutual fund industry has strong incentives to highlight past winners.

Investors are naturally drawn to stories of high returns and “star managers.”

Unfortunately, past success rarely repeats.

At Endeavor Advisors, we believe paying higher fees for a strategy with roughly a 20% chance of success is not a sound long-term plan. Instead, history suggests that disciplined, low-cost, market-based investing offers a more reliable path to financial progress.

Key Takeaways

Professional investors are highly skilled, yet most fail to beat the market over time.

Stock-picking requires being right while the rest of the market is wrong—a very high bar.

Competition and rapidly shared information make persistent outperformance unlikely.

Fees and trading costs significantly reduce investor returns.

Past performance does not guarantee future results, making manager selection risky.

A long-term, market-focused approach helps investors avoid unnecessary complexity and cost.

If you’d like to learn more about how Endeavor Advisors helps investors build durable, evidence-based portfolios, we’re always happy to start the conversation.

—

Source: https://switchpointfinancial.com/investment-myth-3-superior-skill-better-performance/

Endeavor Advisors

Investment

Disclosure: The views expressed herein are exclusively those of Endeavor Advisors, LLC (‘EAL’), and are not meant as investment advice and are subject to change. All charts and graphs are presented for informational and analytical purposes only. No chart or graph is intended to be used as a guide to investing. EA portfolios may contain specific securities that have been mentioned herein. EAL makes no claim as to the suitability of these securities. Past performance is not a guarantee of future performance. Information contained herein is derived from sources we believe to be reliable, however, we do not represent that this information is complete or accurate and it should not be relied upon as such. All opinions expressed herein are subject to change without notice. This information is prepared for general information only. It does not have regard to the specific investment objectives, financial situation and the particular needs of any specific person who may receive this report. You should seek financial advice regarding the appropriateness of investing in any security or investment strategy discussed or recommended in this report and should understand that statements regarding future prospects may not be realized. You should note that security values may fluctuate and that each security’s price or value may rise or fall. Accordingly, investors may receive back less than originally invested. Investing in any security involves certain systematic risks including, but not limited to, market risk, interest-rate risk, inflation risk, and event risk. These risks are in addition to any unsystematic risks associated with particular investment styles or strategies.